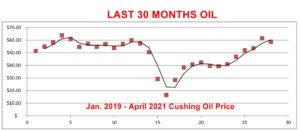

2020 was a rough year for the oil business. The bloated natural gas production associated with attempting to extract oil from wells better defined as gas wells created a glut of natural gas while making the nation a net exporter of oil. That disappeared into the abyss when gas prices in west Texas collapsed into negative territory followed by the oil market seizing up in April of 2020. That resulted in futures markets going into negative territory, in part, due to the sudden decrease in oil demand due to the Covid shutdowns.

2020 was a rough year for the oil business. The bloated natural gas production associated with attempting to extract oil from wells better defined as gas wells created a glut of natural gas while making the nation a net exporter of oil. That disappeared into the abyss when gas prices in west Texas collapsed into negative territory followed by the oil market seizing up in April of 2020. That resulted in futures markets going into negative territory, in part, due to the sudden decrease in oil demand due to the Covid shutdowns.

The recovery was slow. But the election of Biden and his announcement of lease sales being suspended and stopping the Keystone pipeline saw gasoline prices rise substantially. So now that oil prices have recovered from Covid, what is the future?

The future for prices is bright. As we have long said, production of oil is dependent upon a large flush of oil in the early months of production, followed by rapid decline to a low steady rate. While suggesting oil production from legacy wells would stabilize, the total production is dependent upon continually drilling new wells.

On the technical side the experts were wrong. Calling gas wells with a little oil, “oil wells” and estimating reserves by “oil equivalence” on the basis of BTU, inflates the reserves. Predictions of “unconventional” wells making 300,000 barrels of oil and 3 BCF of gas were simply wrong. Most of these wells are more likely to make 40,000 barrels of oil and simply become gas only wells within 3 or 4 years. That 260,000 bbl. is missing and somehow becomes 6 BCF gas, much of which may have been flared off, wasted and making zero income. Most of these wells are losing money for the investors. At prices below $60/bbl, they simply never return the investment and the mineral owner is shafted even worse as companies inflate their costs and deduct unicorn expenses from the royalty owner’s checks.

But production is in rapid decline. Refiners are scrambling to find refinable production. Imports lag. According to the U.S. Energy Information Administration (EIA) refiner utilization is barely 80% of capacity. That plunged as low as 60% during winter as a storm blasted Texas.

Meanwhile gas and oil pipelines in W. Texas are being under-utilized. Appalachia gas production is up, mimicking the Permian glut and resulting in a drop in prices for natural gas there of 63¢ below the Henry Hub benchmark. (https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/041321-appalachian-gas-basis-tumbles-amid-rising-supply-falling-midstream-capacity)

The short answer is that substantial pressure exists to see prices for oil rise, with the glut of natural gas continuing. No fix is in sight. Natural gas can be harnessed in autos and even natural gas diesel engines. The need for more production capacity to back up wind and solar is obvious but conversion to natural gas autos is lagging despite cheap prices (up to 3 or more times the BTU energy of oil in terms of money.) In short, the energy field remains chaotic and unpredictable and the only certain thing is our “energy independence” lasted only one year and likely won’t return for many more.