It baffles me somewhat that there are still a lot of people who get money from an oil company lease but have no idea whatsoever what is the underlying property to that money. In fact, I’ve had people contact me who could not even tell me if they had inherited a mineral interest, or a working interest, or an over-riding royalty interest. They had nary a clue where their money was coming from.

Many seem to think that they “own” a part of a well. Usually, they only own the mineral right, which is a real property interest. They retain only the leased fee interest because a lease, often taken years ago, has transferred the executive rights to a leasehold interest (the oil company.) If you have a mineral interest that is leased, you do not own part of the well, nor the equipment. You don’t have executive rights to control the well, neither its location, its production or who the operator can sell gas to.

It seems complicated. To the uninitiated, it is. But if your parents own a mineral right and gets a mineral check they should share the information among the heirs so that they are not completely broadsided when you return to room temperature.

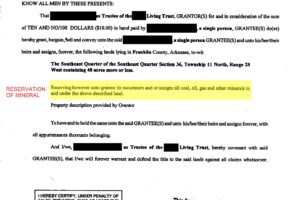

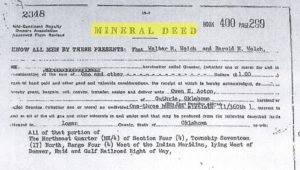

Mineral rights are transferred by either a mineral deed which gives the property from a grantor to a grantee. Or, they are retained as part of a transfer of (most likely) the surface above the mineral right. It looks like one of the two deeds below.

The following items should be retained and all heirs informed of the location they are kept, such as a safety deposit box, scanned and kept of a computer (share those files.) The deed or reservation that shows the interest. Any oil and gas lease, especially those current. Any notice of pooling or unitization. And division of interest (DOI or also called a Division Order -DO). All monthly or periodic check stubs, annual 1099 statements, and any correspondence with the operators.