Depletion allowance is an oft misunderstood tax deduction that accrues not only to oil companies but to the individual royalty owner. Did you know it applies to timber and other minerals as well? It is, in fact, virtually the only deduction that the mineral owner has. Sadly, it is mischaracterized as a “tax loophole” for the rich oil companies.

So just what is depletion allowance? In one word it is depreciation. As your oil is depleted from the reservoir you have lost that resource forever. And, it applies not only to oil and gas, but it is applied to timber, gravel, quarry rock, mining materials, etc. Each are called “wasting” assets. Once removed, they are gone forever. It is no different that the depreciation that would accrue to a business machine or a farmer’s tractor. As you wear it out, the value goes down until it reaches zero. In the case of a tractor, you may use the tractor long after you have deducted the entire 100% of cost. But then if you sell the tractor after you have fully depreciated it, you might be subject to a “capital gains.”

For oil and gas, there are two ways to calculate depletion allowance. First, you can estimate the total reserves of the well that belong to yourself and deduct all costs related to it over the life of the well. Thus you cannot deduct more than invested. For the mineral owner, your investment may be zero. And how do you calculate the reserves? For a small interest, it could cost more to have an engineer estimate the reserves than you get from the well. This is called cost depletion. It works for large oil companies who have engineering staff and have a large capital investment in oil and gas drilling and production.

Percentage depletion is currently 15%. That simply means the IRS allows you to deduct 15% of the annual income for depletion without regard to the actual total volume. You could actually end up deducting more than 100% of the original capital investment. But as a passive mineral owner you have no investment save the original cost which could be zero if you inherited the property or it was part of your fee simple ownership of land.

Percentage depletion allowance is the mineral owners’ only deduction. And it is a partial compensation for the loss of the reserves underground that they own. And do keep in mind that mineral rights are real property rights that you may owe not only income taxes on, but a severance tax, production tax, and/or ad valorem tax. Remember, the depletion allowance only applies to small producers and royalty owners. It does not apply to the major oil companies. They use cost depletion.

Here are some of the items* that percentage depletion applies to in addition to oil and gas.

1. 22% – Asbestos, bauxite, celestite, chromite, corundum, fluorspar, graphite, ilmenite, kyanite, mica, olivine, quartz crystals, rutile, talc, and zircon.

2. 22% – Ores of the following – antimony, beryllium, bismuth, cadmium, cobalt, columbium, lead, lithium, manganese, mercury, molybdenum, nickel, platinum and platinum group metals, tantalum, thorium, tin, titanium, tungsten, vanadium, and zinc.

3. 15% – Oil and gas, gold, silver, copper, iron ore

4. 14% – Bentonite, china and refractory clays

5. 10% – brucite, coal, lignite, perlite, sodium chloride, and wollastonite

6. 7½ % – clays used for pipe, etc.

7. 5% – Bromine, calcium and magnesium chloride

8. 14% – All other minerals including aplite, barite, borax, calcium carbonates, diatomaceous earth, dolomite, feldspar, Fuller’s earth, garnet, gilsonite, granite, limestone, magnesite, magnesium carbonates, marble, mollusk shells (including clam shells and oyster shells), phosphate rock, potash, quartzite, slate, soapstone, tombstones and ornamental stone, thenardite, tripoli, trona, and unless not otherwise listed above, bauxite, flake graphite, fluorspar, lepidolite, mica, and spodumene.

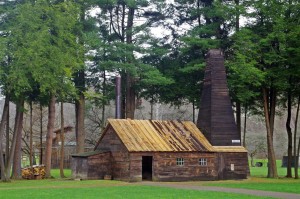

In addition to the items above, depletion allowance also applies to silviculture – forestry. That would include everything from Christmas trees to logging timber.

Further Reading:

Mick Scott’s Mineral Wise link